Accra, Ghana –

Government Borrows GHȼ59.68 Billion in 7 weeks of assuming office from the domestic money market, raising concerns about the potential negative impact on local investors, businesses, and entrepreneurs.

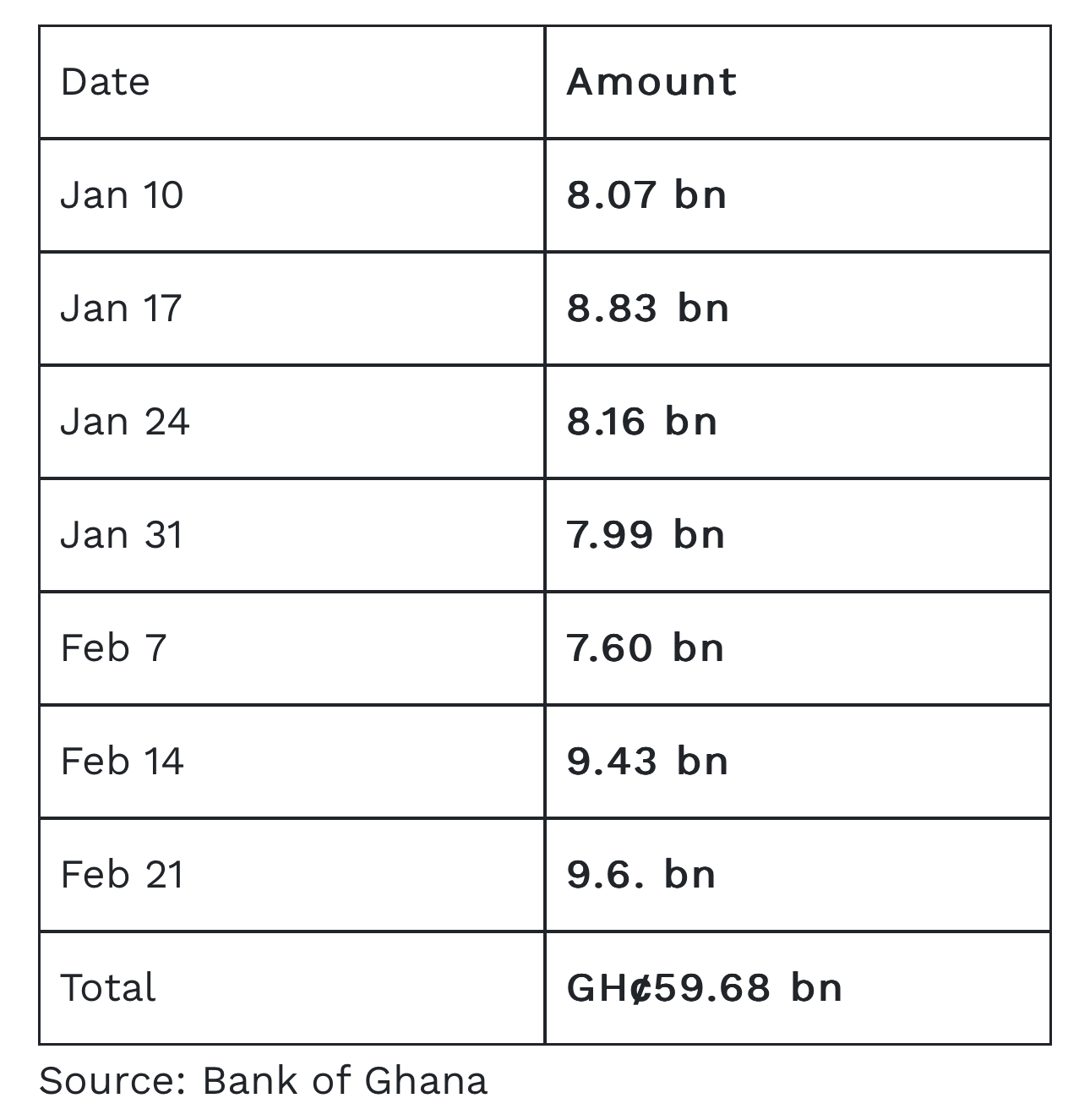

According to data from the Bank of Ghana, the government has consistently borrowed from the domestic short-term market, commonly known as Treasury Bill Auctions, since January 10, 2025—just three days after taking office. The borrowing spree has continued weekly, with the government raising funds through 91-day, 182-day, and 365-day Treasury Bills.

A breakdown of the borrowing shows that the government took GHȼ8.07 billion on January 10, followed by GHȼ8.83 billion on January 17, GHȼ8.16 billion on January 24, and GHȼ7.99 billion on January 31. In February, the government secured GHȼ7.60 billion on February 7, GHȼ9.43 billion on February 14, and GHȼ9.6 billion on February 21.

Economic Experts Warn of Negative Impacts

While Treasury Bills are a common instrument for government financing, economic analysts have raised concerns about the scale and frequency of these borrowings, warning of potential adverse effects on the local economy.

Crowding Out Private Sector Borrowing

The high level of domestic borrowing could make it harder for businesses and entrepreneurs to access credit. Banks and financial institutions, prioritizing the relatively safer government securities, may reduce lending to private businesses, making it difficult for them to secure loans for expansion and operations.

Rising Cost of Borrowing

As government borrows increasingly, interest rates on Treasury Bills are likely to rise to attract more investors. This could push up overall lending rates, making it more expensive for businesses and individuals to access credit. Small and medium-sized enterprises (SMEs), which rely heavily on affordable financing, may struggle the most.

Inflationary Pressures

Experts caution that excessive borrowing could contribute to inflation if the government channels these funds into recurrent expenditure rather than productive investments. Inflation erodes consumer purchasing power and increases operational costs for businesses, potentially slowing economic growth.

Shift in Investment Priorities

With Treasury Bills offering competitive returns backed by government security, some local investors may divert funds from productive sectors such as manufacturing, agriculture, and technology. This could have long-term implications for job creation and industrialization efforts.

Debt Sustainability Concerns

The rapid accumulation of domestic debt raises questions about the country’s long-term fiscal health. If borrowing continues at this rate, the government may struggle with debt servicing costs, potentially diverting resources away from essential sectors like infrastructure, education, and healthcare. Financial analysts and business leaders are urging the government to adopt a more measured approach to borrowing, balancing immediate fiscal needs with long-term economic stability.

While government borrowing is a necessary tool for managing short-term fiscal gaps, the scale of borrowing from the domestic market within such a short period is alarming. It risks squeezing out private sector investment and increasing inflationary pressures. As the